As the role of technology evolves to a more central driving force, India is undergoing a digital revolution, rapidly catching up with its global peers over the last five years.

By Karan Mohla and Deepanshu Pattanayak

Tech-led innovation and disruption will continue to be one of the driving factors globally for years to come and India has taken its place at the center of this confluence. As the role of technology evolves to a more central driving force, India is undergoing a digital revolution, rapidly catching up with its global peers over the last five years. More importantly, it has permeated across multiple socio-economic layers without staying restricted to the top 10% of population driving growth. Today, the impact is at a scale never seen before.

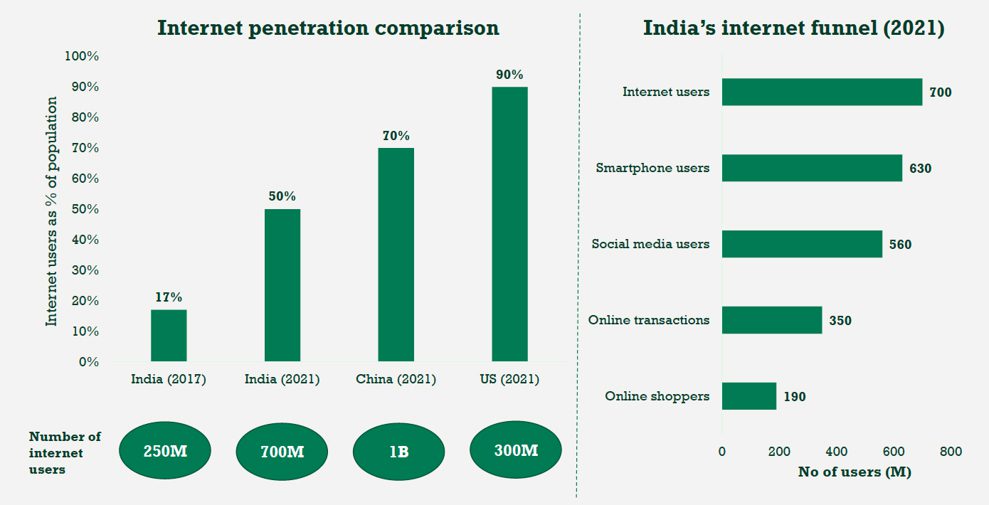

- Internet penetration at 50%+ in 2021 vs 17% in 2017; China at 70% and US at 90%

- 560M users have social media presence; 350M transact online and ~200M shop online

- India’s tech stack has evolved at scale and across multiple touchpoints:

- 3B Aadhaar enrolments

- $1.6T of GTV processed through UPI payments

- ~100M Digilocker users

India Tech Hits Mainstream

2021 was a landmark year for the Indian startup ecosystem, but it didn’t happen overnight. Digitization has been on its course since 2017 and increases exponentially each year, a result of several factors peaking over the past 18+ months.

- $43B of VC funding inflow into India in 2021 across a record breaking 1500+ deals across stages,

- India added a record number of 42 unicorns in 2021 with 17 unicorns and counting in 2022.

- Consumer tech remained dominant but sectors like fintech, SaaS and B2B enablers have birthed more unicorns in the last 2 years than over the previous 8 years

- With greater liquidity came the realization of investments made in prior years. Exits picked up pace and 12 Indian startups including Zomato, Nykaa, Freshworks, Delhiveryand PolicyBazaar went public raising $7B in domestic and global markets.

A key point to note is the active retail investor participation and the general oversubscription of these offerings, showing strong and pent-up latent investor interest.

The B Capital Group Platform

We believe that capital is a commodity and great founders operating in deeper markets will eventually find access to the right type of capital. B Capital’s view is long-term – providing founders access to capital from the first cheque right up to the point of going public. We also focus on building key ecosystem relationships, widening ground presence and bringing an integrated global platform with deep sector expertise for the best founders in our key markets. Our strategic partnership with BCG allows us to provide our portfolio companies access to an unparalleled network of consulting resources to help them overcome their biggest challenges. We look to invest from seed investments as well as at the Series A round, striving to build relationships across the ecosystem with like-minded funds, angel investors and advisors.

What Are We Most Excited About?

We have witnessed secular growth in the Indian tech market in the past three to four years. The focus for B Capital is partnering with emerging companies in Enterprise Software, Healthcare, Financial Services, Consumer Enablement and Industrial & Transportation.

- The SaaS market in India has evolved tremendously and is at a tipping point with multiple companies breaking out. Today, the market has seen 16 SaaS unicorns (vs 1 in 2016) and 60+ companies have raised capital beyond Series C

- At the early stage, we will leverage our global team to go deep across horizontal SaaS, developer tools and SaaS infra as well as deep global verticals.

- Healthcare in India has been lagging in development and leveraging technology remains the only way to circumvent the lack of physical care infrastructure and shortage of healthcare professionals.

- Funding into health-tech has steadily increased and peaked at $2.5B in 2021. Healthcare focused funds and investors have identified India as a key market after US and China.

- Key focus areas include digital health, care management for chronic and critical illnesses, health insurance and surgical care/ops.

- Fintech sector has seen growth over the past couple of years building on top of UPI and India stack. India continues to remain an underbanked country.

- B2B focused financial services, especially around embedded finance, operations enabling platforms for SMEs and insure-tech are key focus areas

While not exhaustive, our teams are spending time in the following areas:

- Decentralized finance (DeFi) and Web 3.0 is a fast-emerging sector. We seek to partner with founders creating the infrastructure for end use applications.

- Sectors making significant contributions to GDP have potential for managed B2B marketplace models to be built to organize traditionally unorganized sectors.

- Large, disaggregated industries where technology plays a central role of aggregation and enablement including logistics, education and agriculture.

The emergence of local funds giving founders access to increased networks, combined with the rise of Tier 1 VCs boosting pre-seed and seed deal access are some of the driving factors why we are excited about early-stage investing in India today.